Bread. Dough. Cabbage. Clams. These are just a few of the hundreds of slang terms that people use for money. Notice how much of this slang is based on food? That’s probably not a coincidence. Food is necessary to sustain life, and so—in a way—is money.

In the classic film

Cabaret, Liza Minnelli and Joel Grey sing a duet with these words: “Money makes the world go around, the world go around, the world go around.” Yet a famous Bible quote says, “The love of money is a root of all kinds of evil” (I Timothy 6:10).

So which is it? Does money make the world go around? Or is the love of money the root of all evil? Surprisingly, both statements can be true.

A business cannot operate without money. Sometimes the owners provide the necessary funds, and at other times people

invest, or put their money into, a business they think will be successful. Once established, most businesses hire people and pay them a salary. With the money they earn, these employees buy food, clothes, and perhaps a car or house. They go to the movies. They take a vacation. They give gifts to their children. They may be so busy working that they hire a teenager to mow their lawn or to babysit—even kids can make money!

Meanwhile, the businesses that sell the food, clothes, cars, and houses, or that run the movie theaters and the hotels at the seashore—all of them are making money. So they hire more people, who in turn buy more goods and services. These are some of the ways in which money makes the world go around, which is another way of saying that money is needed to make an

economy—the way a country uses and produces goods and services—work for everyone.

On the other hand, what people do with their money can hurt an entire economy, too. Greed—the desire for more and more of anything, especially money—can become a root of evil. Driven by greed, people have come up with schemes to cheat other people out of their money. Enron was a giant energy company with headquarters in Houston, Texas. In February 2001, Fortune magazine named it “America’s Most Innovative Company.” Enron claimed to be earning more than one hundred billion dollars every year! That is one hundred thousand million dollars, and it’s written like this: $100,000,000,000. That’s a lot of money. People were eager to work at Enron and to invest their money in the company.

However, just a month later, in March 2001, Fortune magazine ran another article, titled “Is Enron Overpriced?” This article raised questions about the true value of the company. The truth was that Enron was not earning one hundred billion dollars a year. In fact, it was deeply in

debt, owing more than thirteen billion dollars to

creditors that had loaned it money. The fraud was gradually exposed during a two-month period, from October to November 2001. The company collapsed, and some of its

executives went to jail. But average people, who had done nothing wrong, suffered, too. Those who had invested their money in Enron lost all of it. More than four thousand employees immediately lost their jobs. Arthur Andersen, a large company that provided accounting services for Enron, was forced to close its doors, causing another twenty-eight thousand people to lose their jobs. Without jobs, these people had no money; without money, they could not pay for food and housing. There were no toys for their children, no trips to the movies, and no dinners at restaurants. In other words, there was no money going back into the economy.

When the spending stops, everyone suffers. Some

economists— people who study the economy—believe that the Enron scandal helped bring about the economic decline known as the Great Recession (2007–2009), from which we are all still recovering.

That Bible verse, written around two thousand years ago, is often misquoted as “Money is the root of all evil.” That isn’t accurate; money itself is neutral, neither good nor bad. But money is important, because in many ways it does make the world go around, depending on how you use it. In 1931 car manufacturer

Henry Ford said, “Money is like an arm or a leg—use it or lose it.” The question is, how will you use it?

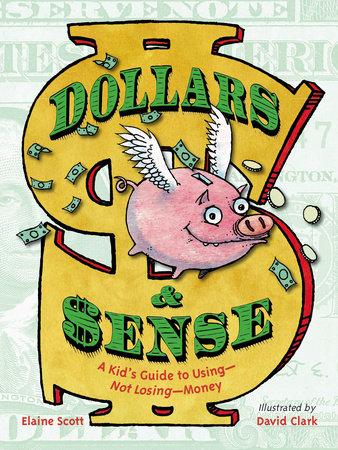

Many items, such as cars, televisions, games, and toys, come with instructions that explain how to operate the product. Unfortunately, money doesn’t come with a set of instructions. Many people learn how to use it—or lose it—by trial and error.

They make mistakes and learn from their mistakes. The information in this book is a little like basic operating instructions for money. After reading it, you will know more about money, how it came into existence, how it has been used through the centuries, and how it is saved, spent, and sometimes wasted. Once you understand money, you can make wise decisions about your own dollars and cents

Copyright © 2016 by Elaine Scott (Author); David Clark (Illustrator). All rights reserved. No part of this excerpt may be reproduced or reprinted without permission in writing from the publisher.